A trader wants to hedge a long stock – In the realm of finance, a trader may seek to hedge a long stock position to mitigate potential risks and enhance portfolio stability. This comprehensive guide delves into the intricacies of hedging strategies, risk management, hedging instruments, and execution.

Understanding the concept of a long stock position and the various hedging strategies available empowers traders to make informed decisions and navigate market volatility with greater confidence.

1. Hedge Types: A Trader Wants To Hedge A Long Stock

A long stock position refers to the ownership of a stock with the expectation that its value will increase. To mitigate the risks associated with this position, traders can employ various hedging strategies.

Hedging Strategies for a Long Stock Position

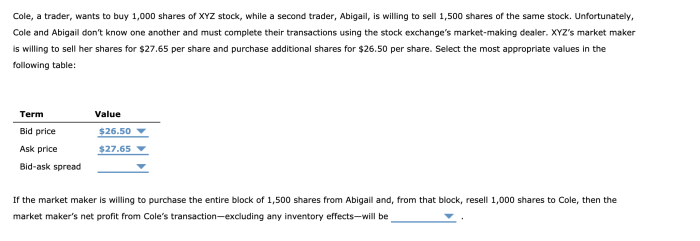

- Selling a Call Option:This involves selling a call option on the same stock, giving the buyer the right to purchase the stock at a predetermined price. If the stock price rises, the call option will be exercised, limiting the trader’s potential profit but also protecting them from significant losses.

- Buying a Put Option:This involves buying a put option on the same stock, giving the trader the right to sell the stock at a predetermined price. If the stock price falls, the put option will be exercised, providing the trader with a profit.

- Selling a Collar:This involves selling a call option and simultaneously buying a put option with the same strike price and expiration date. The call option limits the potential profit, while the put option provides protection against significant losses.

- Buying a Straddle:This involves buying both a call option and a put option with the same strike price and expiration date. This strategy provides protection against both upward and downward price movements but can be expensive.

Advantages and Disadvantages of Hedging Strategies, A trader wants to hedge a long stock

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Selling a Call Option | Limits potential profit, provides downside protection | Restricts potential upside |

| Buying a Put Option | Provides downside protection | Limits potential profit, can be expensive |

| Selling a Collar | Balances potential profit and protection | Can be less effective in highly volatile markets |

| Buying a Straddle | Protects against both upward and downward movements | Expensive, may not be suitable for all market conditions |

Query Resolution

What is a long stock position?

A long stock position represents the ownership of shares in a company, with the expectation that the stock price will rise, resulting in a profit.

Why would a trader want to hedge a long stock position?

Hedging a long stock position aims to reduce the risk of potential losses due to adverse market movements or unexpected events.

What are some common hedging strategies for a long stock position?

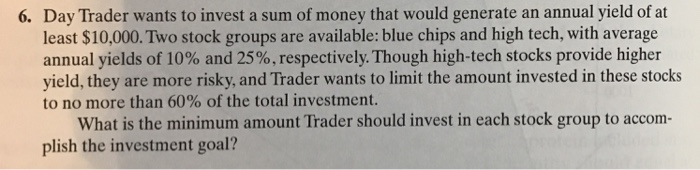

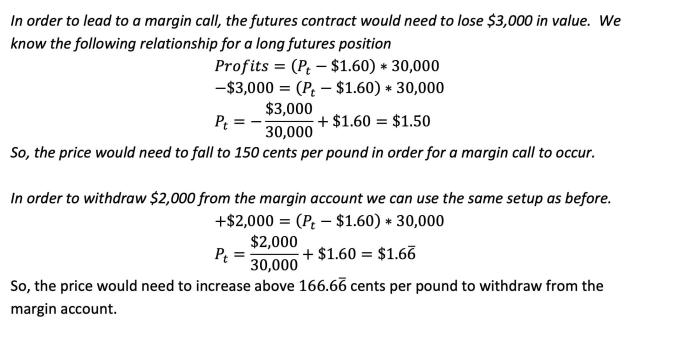

Common hedging strategies include buying put options, selling call options, and using futures or forwards contracts.